The purpose of this article is to assist accounting firms to assess their compliance with strict Australian Competition and Consumer Commission (ACCC) regulations relevant to card payment surcharges.

Since the 1st September 2017, Australian businesses have been banned from profiting from card payment surcharges. The ACCC ban states that surcharges must not exceed the costs of acceptance for each designated payment type.

The ACCC ban applies to:

- MasterCard (credit, debit and prepaid)

- Visa (credit, debit and prepaid)

- Eftpos (debit and prepaid)

The ban does not apply to American Express, Diners Club and UnionPay.

Penalties for breaches can be severe

What costs can be included in a payment surcharge?

Only certain costs can be factored into the amount of surcharge being passed onto the customer. As per the RBA standard, these costs will typically be based on what is charged to the firm by the bank – this may include:

- merchant service fees

- fees paid for the rental and maintenance of payment card terminals

- cost of fraud prevention services

How do I calculate my permitted surcharge?

Calculating your permitted surcharge should be quite simple. The monthly statements from your bank will show the costs for each applicable payment type expressed as a percentage of the value of a transaction.

Can I impose one surcharge across all payment types?

If you wish to impose a single surcharge across multiple payment types, the surcharge cannot exceed the average cost of acceptance of the lowest cost payment type. Typically, this would be a debit card.

What does this mean for my firm?

Are we compliant?

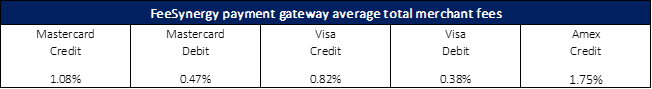

Most accounting firms accept Visa and Mastercard credit and debit card payments either through a terminal or an online payment gateway. Some may not be aware however that merchant fees charged by the bank are much lower for debit cards than credit cards. This is a very important consideration given that debit cards are one of the fastest growing payment trends. To be compliant with the ACCC rules, firms who pass a surcharge onto their clients must take this into account.

How can we become compliant?

Firms who do not pass a surcharge onto their client are automatically compliant. If you do pass a surcharge onto your client, ensure that the amount does not exceed the costs to the firm.

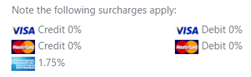

Accounting firms using the FeeSynergy payment gateway are ACCC compliant

%rate are configurable

Client experience is extremely important

Payment gateways are a must for accounting firms. They enable clients to make payments at a time that is convenient to them and in a secure environment.

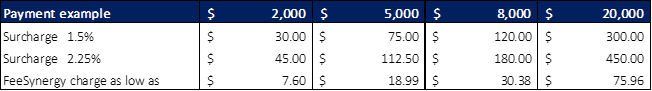

Consider your client; nobody likes card payment surcharges! It is one thing to pay a 1.5% surcharge on a $4.00 coffee – it is another thing entirely when it comes to paying accounting fees in the $’000. Surcharges may “offend” your valued clients and deter them from making prompt payment.

93% of FeeSynergy payment gateway users do not charge a surcharge; and they transact 47% more card payments than those with a surcharge

If you are using a third-party payment gateway provider:

- Are they PCI DSS compliant and if so, at what level;

- Are your clients comfortable transacting through a third-party provider;

- Ensure that the payment gateway is embedded in your firm’s own website and that the client is not taken to another site to transact payment. Your clients are expecting to transact with your firm, not a third party;

- Whose name appears on the client’s receipt for payment and their bank statement – it should only be your firm’s name;

- Are their charges excessive? How would you justify them to your clients?

- Is the payment gateway PC, tablet and mobile phone responsive? A large percentage of payment gateway transactions are done at night (when small businesses do their bookkeeping and pay bills) on mobile devices.

Monthly instalment payment option?

Some payment gateway providers offer a monthly finance payment option which the clients can complete online. These may seem like a good option but there are a number of pitfalls that firms need to closely consider when offering this option.

The FeeSynergy payment gateway also provides a client self-service monthly payment option however its clever design ensures that only eligible legal entities can apply for finance, thereby avoiding consumer finance risk.

Want to know more?

FeeSynergy is the #1 provider of payment gateways and debtor management software and finance solutions used by Australian and NZ accounting firms.

Visit our website www.feesynergy.com.au to book an obligation free demo or call with our experts who will:

- advise you on how to become ACCC compliant;

- advise you on whether you are paying too much for your card merchant facility;

- show you how to improve the client experience;

- discuss how the monthly instalment option works;

- show you how to halve your average debtor days within 2-3 months

Note(s): All information, views and opinions expressed in this paper are those of FeeSynergy Finance Pty Ltd. All amounts and rates expressed in this article exclude GST. Readers should seek appropriate independent advice before acting on any information. More detailed information on the ACCC rules can be found here.