As we dive into the new year, the daily grind is in full swing, and new year resolutions are being set. Yet, for businesses, the early new year months can pose challenges, especially when it comes to maintaining a healthy cash flow. Once the festive fervour subsides, businesses often find themselves grappling with slow paying clients which snow-balls into delays in paying their professional advisor invoices.

If your accounting or legal firm’s cash flow is off to a slow start this year, FeeSynergy is here to help you turn the tide quickly. We specialise in ensuring that your cash flow remains robust and predictable month after month.

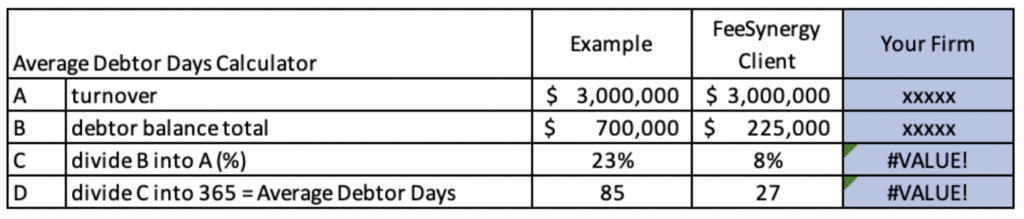

Just like a fitness journey begins with measurements and goal-setting, there are calculations and strategies that can significantly impact your ageing debtor list and, consequently, your cash flow. Follow our example below to gauge how your firm measures up against a typical FeeSynergy Collect user.

In the provided example, 23% of the firm’s turnover is consistently tied up in debtors. Curious about your own stats? Click here to download our Average Debtor Day Calculator.

Imagine a world where you never have to worry about your firm’s cash flow again – always having the funds to cover wages, super, BAS, rent, tech upgrades, and more.

Wondering how this is possible?

Enter FeeSynergy Collect, our automated debtor management and payment solutions platform designed to ensure your average debtor days are consistently under 30 days. This timeframe aligns with the best practice benchmark for leading accounting firms utilising FeeSynergy Collect.

Implementing FeeSynergy Collect isn’t just adding another app to your tech stack; it’s integrating a comprehensive platform that addresses common challenges faced by accounting and legal firms. Beyond enhancing cash flow, FeeSynergy Collect positively impacts your firm’s financial performance.

Our experienced implementation team will guide your firm through the entire process, ensuring your team is fully trained to capitalise on the benefits of the new automated processes and a range of payment solutions that keep cash flowing year-round.

FeeSynergy Collect is a proven and highly secure platform trusted by hundreds of leading accounting firms across Australia and New Zealand. Explore the features below:

- Full integration all major accounting practice management systems – MYOB AE/AO/Advance/GreatSoft, Xero Blue/Green, Access APS, CCH iFirm

- Rich dashboard with customizable data widgets.

- Automated reminders for overdue invoices.

- Online card payments – industry lowest merchant fees – PCI/DSS & ACCC compliance.

- Fee finance with client self-service options – industry lowest interest rates

- Direct Debits – BECS compliant (only $0.30 each).

- Engagement letters and proposals – APES 305 compliant.

- Insights – risky clients data including Equifax credit scores.

- Digital signatures (free) with multiple signature capability.

- Proof of Identity – one click end-to-end solution for biometric facial recognition, document fraud, PEP and Sanctions (only $8.20)

Implementation is a breeze – we do most of the work. Book a free demo today and discover the difference FeeSynergy Collect can make for your firm. Success awaits in 2024!