Identity Verification

FeeSynergy Identity Verification module for Accounting Firms.

A user friendly world-class ID Verification Solution integrated with the leading accounting practice management systems.

Choose a better way to work

FeeSynergy Identity Verification ticks all the boxes...

- Intuitive Client User experience

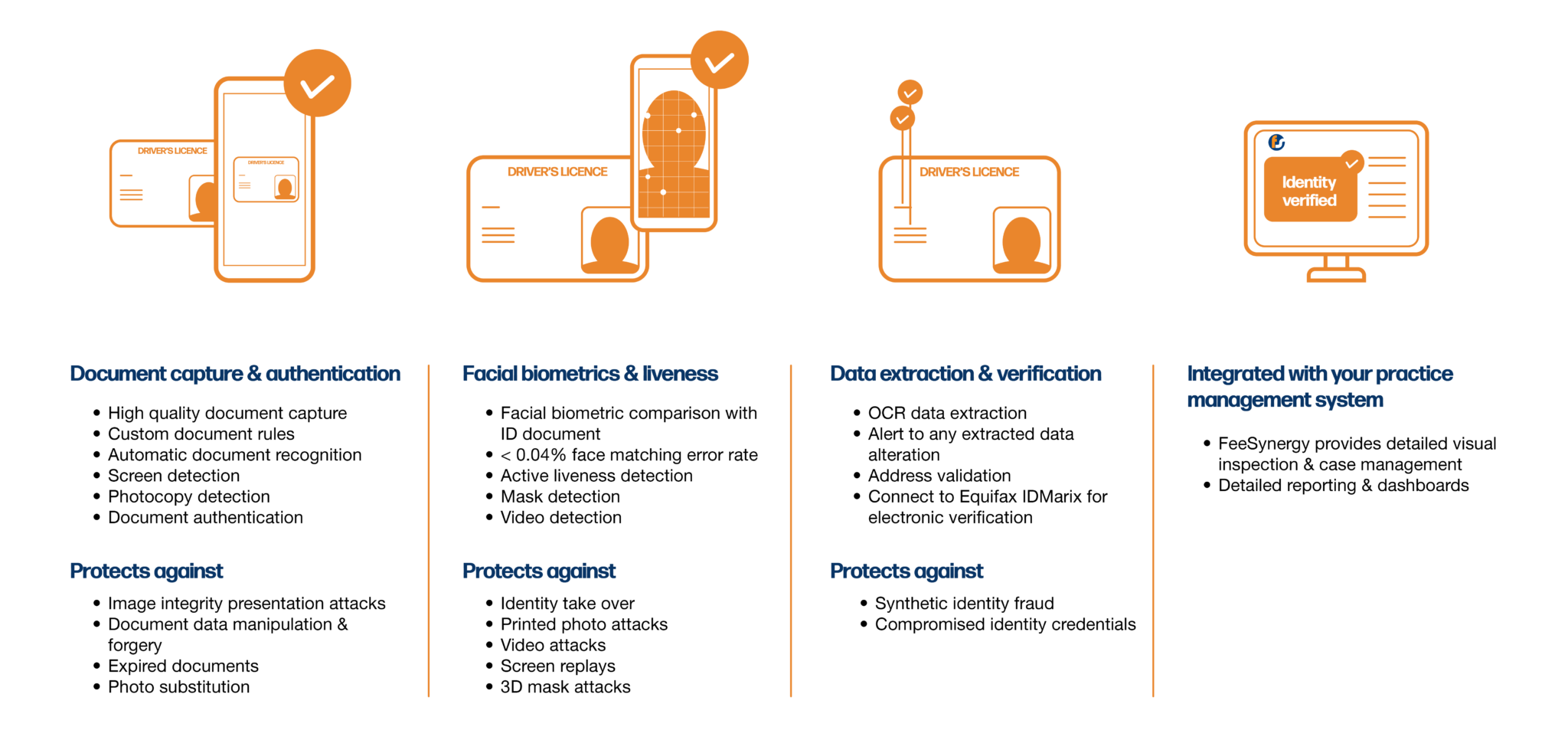

- Biometric Verification – facial recognition with state-of-the-art liveness detection

- Optical character recognition (OCR) – data is automatically read from the source ID document meaning that no manual typing is required by the individual

- Data Verification – Driver’s Licence or Passport – checked and verified against local authority and government agency databases

- Anti Money Laundering (AML) checks – Politically Exposed Persons (PEPs) check and Sanctions checks

One seamless process to provide peace of mind that you are dealing with ‘real’ clients … whom you want to deal with!

FeeSynergy Identity Verification Questions

FeeSynergy integrates with all the leading Practice Management systems in the Accounting industry. These include the following:

Access Cloud, APS, MYOB AE/AO, MYOB Advanced, MYOB GreatSoft, Xero Practice Manager (XPM) and Xero (Blue), CCH ifirm.

In addition , we are always working on other Integrations as they come to market prominence.

By integrating with all the leading PM systems this means the FeeSynergy platform moves with the firm when the firm moves to a new Practice Management System resulting in continuity for the firm.

The FeeSynergy platform is integrated with your Practice Management system so it has visibility to all your clients. By having a ID Verification solution that integrates to your Practice Management system this means that you will be able report on things like how compliant your firm is, how many clients have you verified and when as well as how many clients have not yet been verified. You will also be able to manage the TPB ID Verification reporting requirements across your whole client portfolio in one place.

- Intuitive Client User experience

- Biometric Verification: facial recognition with state-of-the-art liveness detection

- Optical character recognition (OCR): data is automatically read from the source ID document meaning that no manual typing is required by the individual.

- Data Verification: Driver’s Licence or Passport – checked and verified against local authority and government agency databases

- AML checks: Politically Exposed Persons (PEPs) check and Sanctions checks

Once the Identity of your client has been verified all of the sensitive data is automatically deleted. We do not store any of the sensitive ID data after the verification is completed.

- Valid Australian Driver’s Licence/Learner’s Permit

OR

- Current Australian Passport

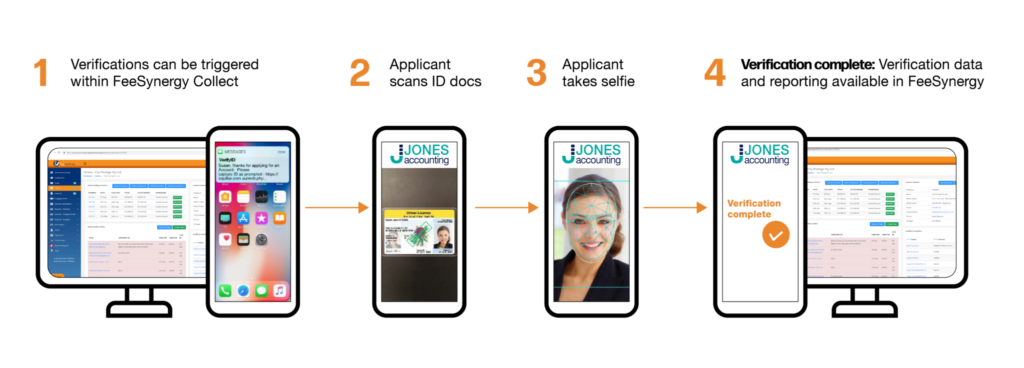

- SMS – A SMS with the Online Identity Verification link will be sent to your clients mobile number

- ID details – your client will be prompted to take a photo of either their Australian Driver’s Licence or Australian Passport, from which we will read your details.

- Selfie – Then the client is prompted to take a selfie, we will match against the photo from your ID Document.

- Confirm & Submit – Lastly the client confirms that the details taken by the system are correct and then they submit!

- DVS check – The details gained via the process above are then submitted to the Government DVS service for verification

- AML / PEP /Sanctions check – the verified identity details are compared to the PEP / Sanctions list

- Ongoing management – The results are pushed back into FeeSynergy for your viewing and ongoing management

On average the verification process should only take your client less than 2 minutes.

Verification can be done on any smart device that has a camera, including laptops with webcams. Though for best results, we recommend using a smartphone less than 5 years old.

We have very detailed reporting capability including being able to create filters and save your own designed reports to better enable you to report on all aspects of managing your TPB requirements in relation to ID verification. The best part of all is as a result of integration with all the leading Practice Management systems this means that you can report on all you clients not just the ones you have Identified but importantly the ones you haven’t identified.

Workflow and Alerts capability is built in our platform in numerous areas. For example, X days after an ID request has been issued to your client our platform will automatically reissue the request if the ID Verification process has not been completed. X days after that follow up request has been made a workflow task is generated to a nominated person in your firm to follow up with the client.