Fee Finance Instalment Options

FeeSynergy are the pioneers of professional fee finance and our facility is utilised by hundreds of accounting and legal firms across Australia and New Zealand. This form of finance provides a valuable payment option for firms to offer their valued business clients so they can meet their commitments even when they are cash flow challenged.

Choose a better way to work

FeeSynergy Standalone Product

The FeeSynergy fee finance facility is a standalone product however it has been fully integrated into FeeSynergy Collect. This level of integration means that the credit manager has complete visibility of the client’s debt position at the time they are negotiating payment terms with the client and whilst preparing the fee finance quote/loan document.

The inbuilt smarts within both the standalone and Collect products ensures that the finance documents are only produced for entity types that are allowed to borrow (including companies, partnerships, trusts and sole traders). Fee finance is prohibited to be provided to super funds or consumers.

FeeSynergy Fee Finance Instalment Options ticks all the boxes...

Standalone

- FeeSynergy provide the firm with user friendly cloud-based quoting software

- Entity name checked and verified by inbuilt ABR Search to ensure the loan documents are in the correct legal entity

- Full reporting enables you to track clients loan payment transaction history

- Range of monthly options to suit client cash flow – 3, 4, 6, 8, 10, 12

- Instalments payable by direct debit – bank account or credit card (low 0.85% surcharge)

- FeeSynergy pay the full invoice amount to the firm within 3 days of the initial direct debit draw

- FeeSynergy do all the work managing the monthly direct debit process including follow up of clients if their payments default

Integrated FeeSynergy Collect

Additional to all the features of the standalone product…

- Straight from the dashboard, within 3 clicks the firm can generate all quotes and loan docs. No typing required.

- Documents auto populated

- Documents emailed to client for digital completion and signature

- Firm verify digital signature and auto-submit to FeeSynergy to process

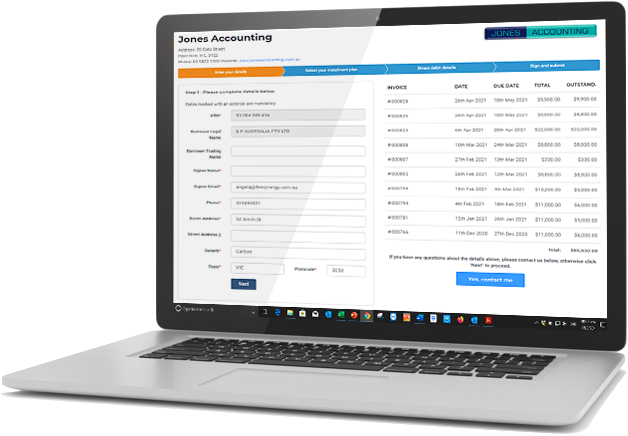

Client Self-Service Loan Applications

This optional feature saves time and speeds up the fee funding settlement process

- Online applications with digital completion and signatures

- Monthly instalment options are set to your business rules

- Full audit trail of application process

- Direct debits from bank account or credit/debit cards

A fee finance facility is a must for all accounting and legal firms. A FeeSynergy facility is free of charge to the firm as it is the client of the firm paying the interest charge. FeeSynergy typically has the lowest interest charges in the market.

FeeSynergy Fee finance Questions

FeeSynergy provides finance to commercial entities (ABN, ACN or NZBN holders) to fund business related accounting and legal fees.

12 months. We encourage firms to offer shorter terms that match the client’s cash flow. This saves the client interest costs and reduces the firm’s contingent liability more quickly.

No. FeeSynergy only provides commercial finance. It does not provide finance to consumers as this places onerous licencing obligations on all parties as defined under the National Consumer Credit Protection Act 2009.

Yes. FeeSynergy’s experienced loan administration team will follow up these clients in a professional and courteous manner. Our flexible approach ensures that 99% of clients are able to meet their repayment obligations.

The interest rates vary based on the loan term and the amount being financed. FeeSynergy typically has the lowest rates and fees in the industry.