Definitionally, a business workflow is a repeatable process that consists of a series of tasks that generally need to be completed in a specific sequence to reach a specific business objective. While the number of tasks in each workflow can vary, every workflow is made up of 3 basic components.

Because cashflow is a constant concern for many accounting and legal firms, this blog article primarily focuses on debtor management (cash collections) workflows.

Relevant to debtor management:

- Trigger event: this would be when an unpaid client invoice reaches a pre-determined age (eg 7 days after the invoice payment was due);

- Series of tasks: this would be the timeline in the firm’s credit policy when overdue invoices are followed up with clients or escalated to managers or partners;

- Results: this would be measured by how long it took to receive payment.

FeeSynergy are the leaders in debtor management workflow for accounting and legal firms across Australia and New Zealand. In our Collect platform, we customise workflows to suit our client’s business rules … and not just for debtor management … but also for important compliance processes such as Direct Debits, Engagement Letters and Identity Verification (KYC).

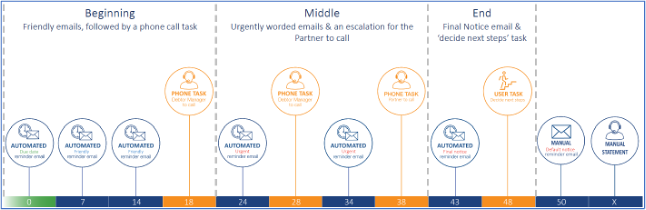

On the topic of debtor management, FeeSynergy has broken down the process of being paid into 3 distinct workflow stages:

1. Beginning – client invoice payments are now slightly overdue

2. Middle – client invoice payments are now well overdue

3. End – clients are very slow to pay and more affirmative action is required

The above diagram is a good example of a FeeSynergy Collect workflow configuration that achieves great results without harming the relationship between the service provider and their client.

In arriving at a suitable workflow with an accounting or legal firm client, our experienced implementation team review the firm’s:

- invoicing process in their practice management system – FeeSynergy integrates with all leading PMS

- existing credit policy

- client payment terms – typically 14 days but can vary at client level

- mix of client types and services they are provided

- target average debtor days – should be less than 30 days

- appetite for “going soft or hard” on cash collection.

Does your firm need proper debtor management software?

To implement the type of workflow processes that FeeSynergy recommend (and we know gets results) the simple answer is YES.

In our experience, no matter how experienced and productive your credit managers are, it would be superhuman of them to operate at the same level of cadence as depicted in the above workflow without such a system. These valuable staff should be utilised for the all-important “Phone Tasks” that require strong communication and negotiation skills. With more time to talk to clients, it’s easy to create tasks, record notes, create direct debit or fee finance arrangements whilst on the call. In a worse-case scenario, if the firm need to “go legal” to chase a bad debt they will have a fully recorded history of their collection activity (within FeeSynergy Collect) that will be required by the appointed solicitor to commence recovery action.

FeeSynergy Collect workflow ticks all the boxes!

- your clients are prompted to settle their accounts via automated bulk email reminders.

- email reminders and tasks are fully configured to your business rules, sent when you choose.

- clients can click a link in the reminder to view their invoice/s and current statement.

- you can see if the client has received the reminder and opened the email.

- clients can click a link in the reminder to make credit or debit card payments directly into the firm’s payment gateway.

For more information email info@feesynergy.com.au or click to book a free demo today