FeeSynergy Direct Debits

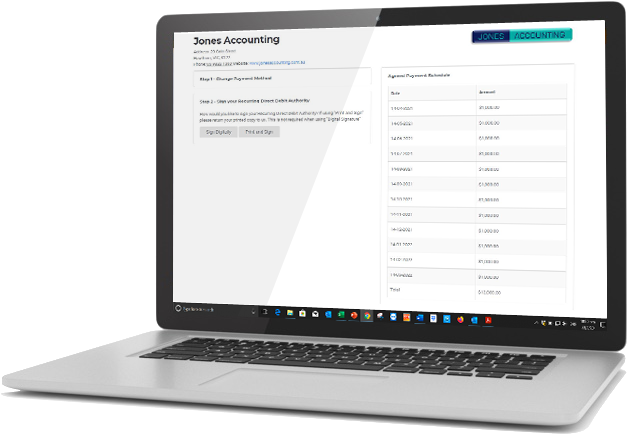

FeeSynergy Collect incorporates a fully integrated Direct Debit module. It enables users to easily set up and manage Direct Debit arrangements via bank account or credit/debit cards in a flexible and secure environment.

Choose a better way to work

FeeSynergy Direct Debit ticks all the boxes...

Direct Debits are administered by the Australian Payments Network through the Bulk Electronic Clearing System (BECS). There are strict regulations that firms must comply with including:

- provide clients with a bank approved Direct Debit Request (DDR)

- provide clients with a bank approved DDR Service Agreement (DDR SA)

- verify that the person/s signing the DDR are authorised to do so

- the DDR must show the name of the firm, their address and bank provided User ID

- the client must know for what services the amounts are being direct debited

- the signed DDR must be kept and retrievable (on 3 days’ notice) for at least 7 years after the last direct debit was processed

FeeSynergy has done all the hard work to enable client firms to be BECS compliant and reap the many benefits of a Direct Debit offering. And all at an unbeatable bank transaction rate of $0.30 per transaction.

FeeSynergy Collect Questions

FeeSynergy Collect is very secure. It is regularly independently penetration tested by Australia’s leading information security company. All data is hosted and supported in PCI/DSS compliant Amazon Web Services (AWS) data centres located in Australia

No. All FeeSynergy software is implemented by FeeSynergy’s highly experienced team.

FeeSynergy Collect can be implemented in as little as 2 weeks however we suggest allowing 4-6 weeks. This is not a big IT project … the experienced FeeSynergy team do all the heavy lifting to ensure that the implementation runs smoothly.

FeeSynergy Collect is a SaaS offering. Pricing is based on the firm’s annual turnover. The return on investment (ROI) is usually within 3 months of go-live.