Welcome to 2022 and what is already shaping up to be another year of challenges for us all. At FeeSynergy our goal is to make sure that Cashflow isn’t one of them, for you.

Has your accounting firm come back from the New Year break to a depleted bank account and rapidly ageing debtor book? Worried about cashflow over the next couple of months?

By contrast, if your firm were using FeeSynergy’s automated debtor management and payment solutions platform (FeeSynergy Collect), you will have come back to a healthy bank account and less than 30 average debtor days (this is where our client’s average debtor days are currently sitting).

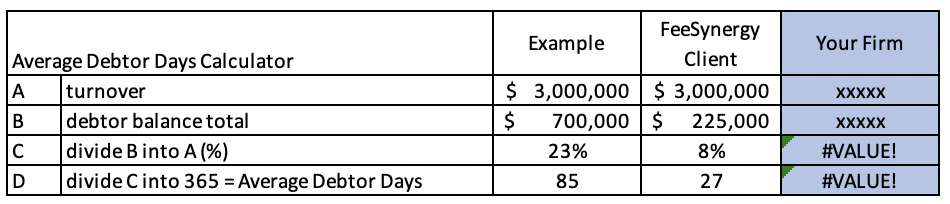

Do you know how to quickly calculate your average debtor days? Follow the example below and see how your firm stacks up against a typical FeeSynergy Collect user firm.

In the Example above; what this means is that 23% of the firm’s turnover is tied up in debtors at all times!

Click here to download the Average Debtor Day Calculator

Let’s be honest, the thought of a New Year and adding another app into your firm’s tech stack can be a bit daunting. FeeSynergy Collect however is “not just another app”, it is a platform that brings together a range of integrated solutions to problems common to most accounting (and legal) firms. FeeSynergy Collect will positively impact the firm’s financial performance well beyond cashflow. And when it comes to implementation, our experienced implementation team will manage the project from start to finish to ensure that your team is fully trained and ready to capitalise on the new automated processes and a range of payment solutions that will keep the cash flowing irrespective of the time of year.

Our proven and highly secure platform is used by hundreds of leading accounting firms across Australia and New Zealand.

Not only will our Collect platform solve your cash flow problems once and for all, it will help you better manage or solve problems that your firm may be dealing with in a number of areas.

- Fully integrated with leading practice management systems including APS, MYOB, GreatSoft and Xero

- Rich dashboard with plenty of data widgets to choose from

- Automated reminders for overdue invoices (customised)

- Online payment gateway – credit cards and debit cards (incl AMEX) PCI/DSS and ACCC compliant

- Fee finance with option for client self-service (monthly instalments with lowest rates in industry)

- Direct debits – multiple use cases (only $0.30 each) BECS compliant

- Engagement letters and proposals (APES & TPB compliant)

- Risk management and business advisory tool (including Equifax credit scores)

- Digital signatures – multiple signature capability ($free)

Implementing our solutions is easy … we pretty much do all the work … so book a free demo today and see the difference FeeSynergy Collect can make for you.