We live in a world of online payments. COVID-19 has only reinforced the fact that clients want simple to use 24/7 online payment facilities and peace of mind when making such transactions. In this day and age, accounting and legal firms who do not offer online payment facilities are well and truly behind the times.

Why your firm needs a Payment Gateway

We live in a world of online payments. COVID-19 has only reinforced the fact that clients want simple to use 24/7 online payment facilities and peace of mind when making such transactions.

In this day and age, accounting and legal firms who do not offer online payment facilities will be seen by their clients to be “behind the times”. Most accounting and legal firms send their invoices and statements to customers electronically meaning that online payment facilities are no longer a “nice to have”, they are a “must have” facility.

FeeSynergy’s proprietary Online Payment Gateway is the most widely used by Australian and New Zealand accounting and legal firms. Our unique payment gateway enables the firm’s clients to make online credit card and debit card payments in a secure bank to bank environment.

How does the FeeSynergy Payment Gateway work?

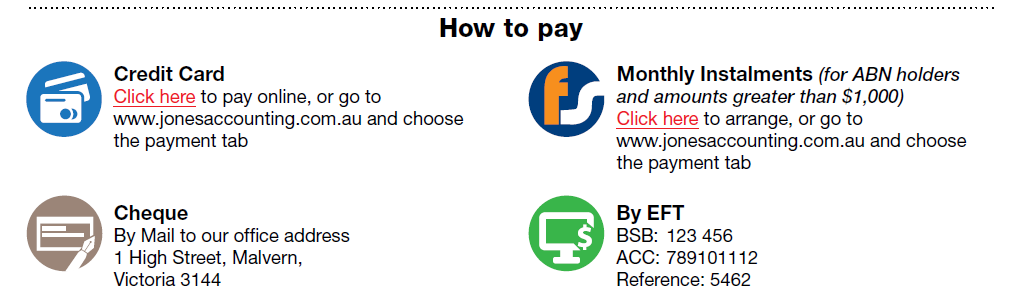

When your client wishes to pay your invoice with a credit or debit card, they can either go to your website and click on the payment button or simply click on the URL that can form part of your invoice design. Below is a sample of FeeSynergy’s invoice remittance advice with active links. All FeeSynergy client firms use this invoice design with great results (with or without Cheque and BPAY options).

Why firms should choose the FeeSynergy Payment Gateway

Client User Experience

The payment gateway is embedded into the firm’s website and is PC, tablet and mobile phone responsive. This is important as a large percentage of payment gateway transactions are done on mobile devices at night and on weekends when small businesses do their bookkeeping and pay bills.

At no time does the client leave the firm’s website. Your clients are expecting to transact directly with your firm, not a third party. The firm’s name shows on the receipt for payment and the client’s bank statement.

Having a payment gateway embedded into the firm’s own website presents a valuable opportunity for the firm to market its range of service.

Security

The FeeSynergy Payment Gateway is extremely secure. The client’s credit or debit card details are only held by our bank partner so the firm does not need to worry about compliance with the Payment Card Industry Data Security Standard – PCI DSS.

When taking credit or debit card payments over the counter or over the phone, your staff member can simply go onto your website and enter the client’s card details directly into the Gateway. The client and the firm will receive immediate confirmation of payment.

Monthly Payment Option

This is the only payment gateway that offers FeeSynergy’s monthly payment facility as a fully integrated feature. Firms must firstly be accredited with FeeSynergy to be able to offer this payment option. Accreditation is free for qualifying accounting and legal practices.

This is your facility!

Professional service firms should have their own online merchant facilities. Having your own facility means that you have control over the fees and charges that are passed onto your clients. Additionally, as the client is transacting directly into the bank’s merchant system there is minimal wait time for funds to be deposited into the firm’s bank account.

Special pricing

FeeSynergy has negotiated a very attractive rate structure with our bank partner/s. This means that most firms will enjoy merchant fees well below the level they might normally be charged by their own bank. This is great for the firm and its clients. Firms have the option of nominating what level of surcharge they will pass onto their clients. The clever design enables firms to set different levels of surcharge for credit cards and debit cards. This important feature enables firms to comply with excessive surcharging regulations (refer ACCC blog article https://feesynergy.com.au/is-your-firm-complying-with-accc-card-payment-surcharge-laws/ )

Implementation timeline

The design of the payment gateway is one of “plug and play”. Clear and simple instructions will be provided to the firm’s website developer to load and test. In most cases we will be able to have the firm live on the payment gateway within 2 weeks of receiving the signed agreement.

Next steps

The FeeSynergy Payment Gateway is available to all Australian and NZ accounting and legal firms. FeeSynergy has done all the hard work to bring this solution to market at a fraction of the cost of what it would cost an individual firm to develop on its own. FeeSynergy charges a low upfront licence fee and a nominal annual fee to cover hosting and support costs.

For further information please email hello@feesynergy.com.au