Owners of successful businesses often find their net worth grows significantly on paper, yet their access to that wealth remains limited and tied up in the business.

At the Australian Business Growth Fund (ABGF), we believe that if a business has achieved profitability milestones and has significant growth potential, owners should be able to ‘take money off the table.’

As advisors to your clients, it’s important to inform them that opting for a partial sell down of shares to a minority investor allows an owner to secure an immediate financial benefit while maintaining potential future gains. An experienced investor, collaborating closely with you and other advisors, can help your clients achieve success sooner.

The Transformative Power of Partial Liquidity

Taking money off the table, or ‘partial liquidity,’ is beneficial for a business. Without a liquidity event, a founder’s risk appetite may shift from maximising growth to preserving wealth.

A large portion of an owner’s net worth is usually tied up in the business. In times of economic uncertainty, this focus on wealth preservation increases, highlighting the need for alignment among shareholders regarding risk tolerance.

As trusted advisors, you play a key role in facilitating avenues for your clients to achieve partial liquidity. Coupled with the support of an investor, this can pave the way to more ambitious expansion strategies. After a partial liquidity event, founders have the cash to pay for major financial commitments, such as investing in their children’s education, providing further options and security.

The Dual Pay-Day with a Minority Sale

Liquidity can be achieved through various financial transactions – i.e. full sale, majority sale and minority sale – each with different implications for the founder’s future and the business’s growth prospects.

The purpose of this article is to focus on the benefits of a minority sale and the potential ‘dual pay-day’ this can unlock for founders – enabling them to de-risk while still participating in future growth.

Let’s consider this question: would a founder be better off with a complete sale or a minority sale to an experienced investor?

Let’s compare these options through the hypothetical scenarios below:

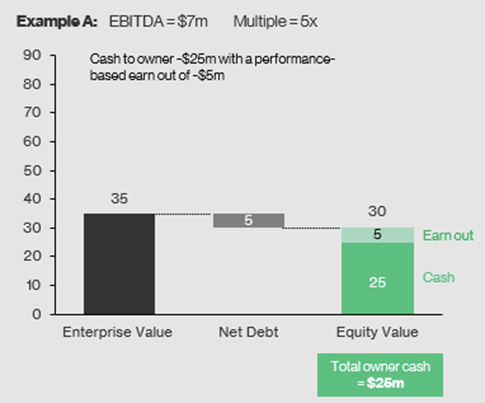

Example A: The founder sells 100% of a business with an enterprise value of $35m (including $5m debt). The founder receives $30m — $25m in cash and a $5m performance-based earn-out.

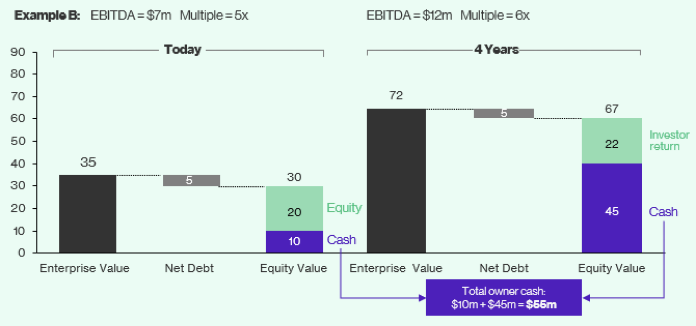

Example B: The founder sells a portion of their equity to a growth capital investor for $10m, immediately de-risking their financial situation. The investor helps accelerate the business’s growth, and four years later, the founder could receive another $45m in a full sale. In total, they receive $55m across two liquidity events.

Example B is only possible by partnering with an experienced growth capital investor who believes in the founder’s vision and offers a collaborative pathway to scaling the business.

Why is founder liquidity important, and can multiple liquidity events be better than just one? Watch the video below from Tim Stevenson, ABGF’s Business Development Manager, to gain additional insights into dual liquidity events.

WHY FOUNDER LIQUIDITY MATTERS – VIDEO

Liquidity and Alignment

Allowing founders to take money off the table initially so they can enjoy the upside of further growth enables them to be more ambitious about the business’s growth trajectory. This aligns with ABGF’s mandate. ABGF is Australia’s only purpose-built growth capital fund dedicated to investing in Australian entrepreneurs, disruptors, and growth-oriented businesses. ABGF supports ambitious founders who want to partner with an active investor, accelerate the business’s growth, and establish sustainable foundations for a liquidity event in the future.

As a trusted advisor, it’s essential to understand the opportunities that founder liquidity can offer. By guiding your clients towards options like partial liquidity with a growth capital investor, you can help them achieve both financial security and future prosperity. Encourage your clients to explore how ABGF can support their business goals and provide a pathway to sustainable growth and successful liquidity events.

Founder liquidity matters. Partial liquidity offers a compelling pathway for founders to achieve both financial security and future prosperity while aligning incentives with long-term growth-focused investors.

Visit ABGF’s website to learn more about the businesses we’ve invested in.

ABGF engages in proprietary trading for its own account, does not hold an Australian financial services license and does not provide financial product or investment advice, or any other financial services, to investee entities. Anyone who makes a decision to engage in a transaction with ABGF will be required to acknowledge and agree that it will make its own independent decision to enter into each transaction and each transaction is appropriate based on its own judgement and advice from such advisors that it deems necessary.