For many professional service firms, the 2025 financial year has seen a significant slowing down in payments from customers, including those that typically pay within normal 14 day trading terms.

The good news is that the vast majority of overdue debtors are happy with the work performed by their provider, understand that they need to pay and will be willing to negotiate a payment arrangement of some type.

My own team of professional credit managers have heard “every excuse under the sun” as to why customers are unable to pay – most are sincere and the common reasons given are … I don’t have the money right now … I am waiting on my customers to pay me … I am waiting until I get my tax refund … I never received a the invoice … I am waiting for the sale of my property to go through.

When talking to customers with overdue invoices it is important to be empathetic but ensure you go into every discussion well prepared and ready to offer a range of payment solutions to achieve a win-win outcome.

To prepare for such a discussion I recommend the following:

- Understand the client’s history with your firm…

- how long a client?

- how much do they pay the firm annually?

- are they usually good payers?

- What industry are they in?

- is it an industry under stress?

- How much do they owe and how old are the overdue invoices?

- Is there any WIP that is due to be billed?

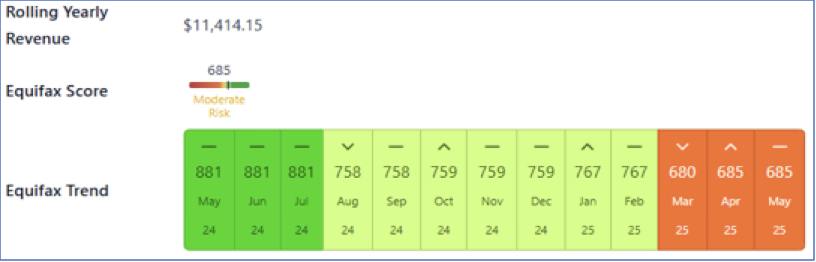

- What is their Equifax Credit Score?

- has it been deteriorating (like the example below)

If the discussion is going to be of a more serious nature that could result in formal debt recovery action:

- Check to see if there is a current Engagement Letter in place?

- Does it cover the scope of work in the invoices?

- Is the person who signed the Engagement Letter the person you will be calling?

- Does it include a debt recovery clause?

A Debt Recovery Clause protects the interests of the firm providing the service, offering a reliable mechanism to address and recover unpaid debts. A simple clause along the following lines will go a long way to bolstering your engagement letters …

“The Client shall pay to [name of firm] on demand all costs, charges and or expenses incurred by [accountant firm] in consequence of any default on the part of the Client in performing or observing any term of these Terms of Agreement, or in exercising or enforcing (or attempting to do so) any rights or remedies of [accountant firm].“

Note: Whatever clause you decide upon, you should check to ensure that it adheres to relevant legal guidelines.

Finally, following up overdue invoices is “not every one’s cup of tea”. It requires a professional approach and pre-call preparation. Go into every call with a plan to achieve a result during the call; one that works for you and the customer.

For more information on this topic including information on Equifax Credit Scores contact Dean Phillips via email deanp@feesynergy.com.au